Alternote 1 0 18

Red Rock Resorts, Inc. (NASDAQ:RRR)

Red Rock Resorts, Inc. (NASDAQ:RRR) closed at $17.77 on the last trading session with an increase of 2.48%, whereas, it previously closed at $17.34. The company has a market capitalization of $2.05 Billion. The company traded shares of 934953 on the trading day while its three month average volume stands at 1.95 Million.

Now to discuss some of the Earning per Share estimates and growth estimates, shares of Red Rock Resorts, Inc. (NASDAQ:RRR) produced diluted EPS of -3.35. The EPS estimate for next year as estimated by analysts is at 0.18 while EPS for next quarter is estimated at 0. Earnings per Share growth for this year is reported at -103.6, while the analysts estimated the EPS growth for next year at 0.18% and Earnings growth for next 5 years stands at 0% as estimated by the analysts. While Annual EPS Growth rate for past five years as reported by the company is at -15%.

Some important ratios are also vital to discuss the performance of the company and its shares. The P/E or Price to Earnings ratio of Red Rock Resorts, Inc. (NASDAQ:RRR) is at 0 while the forward p/e is at 100.4. The P/S or Price to Sales ratio of Red Rock Resorts, Inc. (NASDAQ:RRR) stands at 1.45 and Price to Book or P/B for the most recent quarter stands at 4.53. The Price to Free Cash Flow ratio or P/FCF is reported at 7.61. The quick ratio and the current ratio of Red Rock Resorts, Inc. (NASDAQ:RRR) are reported at 2 and 2 respectively. The Return on Assets ROA, Return On Earnings ROE and ROI Return On Investment for Red Rock Resorts, Inc. (NASDAQ:RRR) stands at -5.5, -57.8 and 4.7 respectively

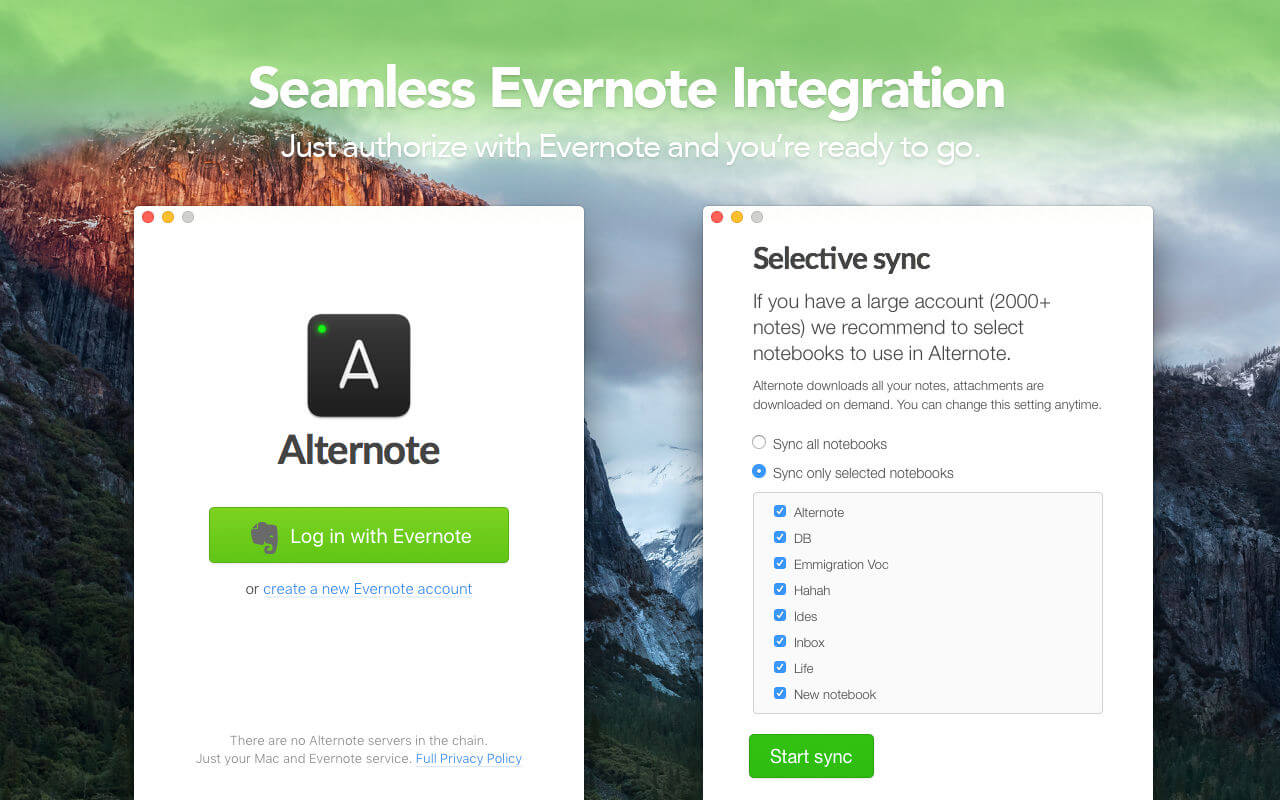

- Alternote is a note-taking app for Mac OS X. Alternote is an alternative Evernote client for Mac with Markdown support. Discover Alternote alternatives, reviews, features and functionalities.

- 4005 W McNab Rd # 202, Pompano Beach, FL 33069 is a condo listed for rent at $1,200. Condo is a 1 bed, 1.0 bath unit. Find 18 photos of the 4005 W Mcnab Rd #202 condo on Zillow.

The trailing twelve month Revenue of Red Rock Resorts, Inc. (NASDAQ:RRR) is reported at 1.41 Billion with income of -234600000. The outstanding shares of Red Rock Resorts, Inc. (NASDAQ:RRR) are 70.52 Million. The institutional Ownership of the shares of 87.2 stands at 0.80%, this figure is decreased -5.94 in the last six months. The insider ownership for the shares of Red Rock Resorts, Inc. (NASDAQ:RRR) is ticked at 3.96%, the figure is rose 109.08% in the last six months.

【期間限定特売】のdrv-mr745 前後撮影対応2カメラドライブレコーダー kenwood/ケンウッド 32gbsdカード付属 スタンドアローン型 広視野角高画質長時間録画駐車監視コンビニ受取対応品 led クラリオン レイブリック 楽天物流より出荷 コンビニ受取不可:オートウイングdrv-mr745 前後撮影対応2.

Some other important financial aspects to be discussed here for Red Rock Resorts, Inc. (NASDAQ:RRR) is the Mean Target Price estimated by the analysts which stands at 18.88. The 52 week high of Red Rock Resorts, Inc. (NASDAQ:RRR) is placed at 27.91 and 52 week low is standing at 2.76.

Performance wise the shares of Red Rock Resorts, Inc. (NASDAQ:RRR) rose up 3.92% for the week, it also rise 3.62% for the monthly performance, while for the quarter it went down 78.06%. The shares increase 79.68% for the half year and plummeted for the Year-To-Date performance. The shares of Red Rock Resorts, Inc. (NASDAQ:RRR) shrinked -10.66% for the yearly performance.

Endeavour Silver Corporation (NYSE:EXK)

Endeavour Silver Corporation (NYSE:EXK) closed at $3.35 on the last trading session with an increase of 1.82%, whereas, it previously closed at $3.29. The company has a market capitalization of $542.73 Million. The company traded shares of 1.57 Million on the trading day while its three month average volume stands at 5.91 Million.

Now to discuss some of the Earning per Share estimates and growth estimates, shares of Endeavour Silver Corporation (NYSE:EXK) produced diluted EPS of -0.31. The EPS estimate for next year as estimated by analysts is at 0.26 while EPS for next quarter is estimated at 0.04. Earnings per Share growth for this year is reported at -267.1, while the analysts estimated the EPS growth for next year at 0.26% and Earnings growth for next 5 years stands at 0% as estimated by the analysts. While Annual EPS Growth rate for past five years as reported by the company is at 13.6%.

Some important ratios are also vital to discuss the performance of the company and its shares. The P/E or Price to Earnings ratio of Endeavour Silver Corporation (NYSE:EXK) is at 0 while the forward p/e is at 12.88. The P/S or Price to Sales ratio of Endeavour Silver Corporation (NYSE:EXK) stands at 5.15 and Price to Book or P/B for the most recent quarter stands at 3.85. The Price to Free Cash Flow ratio or P/FCF is reported at 0. The quick ratio and the current ratio of Endeavour Silver Corporation (NYSE:EXK) are reported at 2.5 and 3.1 respectively. The Return on Assets ROA, Return On Earnings ROE and ROI Return On Investment for Endeavour Silver Corporation (NYSE:EXK) stands at -26.8, -35.4 and -36.2 respectively

The trailing twelve month Revenue of Endeavour Silver Corporation (NYSE:EXK) is reported at 105.3 Million with income of -43900000. The outstanding shares of Endeavour Silver Corporation (NYSE:EXK) are 154.99 Million. The institutional Ownership of the shares of 26.4 stands at 0.80%, this figure is increased 11.43 in the last six months. The insider ownership for the shares of Endeavour Silver Corporation (NYSE:EXK) is ticked at 2.4%, the figure is rose 0% in the last six months.

Some other important financial aspects to be discussed here for Endeavour Silver Corporation (NYSE:EXK) is the Mean Target Price estimated by the analysts which stands at 4.47. The 52 week high of Endeavour Silver Corporation (NYSE:EXK) is placed at 4.79 and 52 week low is standing at 0.99.

Alternate 1 0 18 Mm

Performance wise the shares of Endeavour Silver Corporation (NYSE:EXK) fell down -4.56% for the week, it also fell -16.46% for the monthly performance, while for the quarter it went down 34.54%. The shares increase 155.73% for the half year and flew up for the Year-To-Date performance. The shares of Endeavour Silver Corporation (NYSE:EXK) grew 36.18% for the yearly performance.